Current Projects

Markups and Cost Passthrough along the Supply Chain

Santiago Alvarez-Blaser, Alberto Cavallo, Alex Mackay and Paolo Mengano

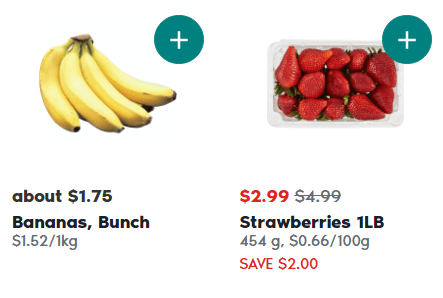

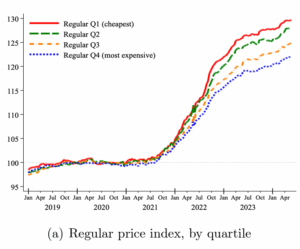

Cheapflation and Inequality

Alberto Cavallo, Julian Hidalgo, Gaston Garcia Zavaleta, Oleksiy Kryvtsov, and Matias Vieyra

Detecting Turning Points in Inflation:

A Structural Breaks Approach

Alberto Cavallo and Gaston Garcia Zavaleta

Our Team

Alberto Cavallo

Founder & Principal Investigator

Alexander MacKay

Founder & Principal Investigator

Julian Hidalgo

Post-Doctoral Fellow

Paola Llamas

Research Assistant

Franco Vazquez

Research Assistant

Santiago Alvarez-Blaser

Research Collaborator

Paolo Mengano

Research Collaborator

Michael Sullivan

Research Collaborator

Gaston Garcia Zavaleta

Research Collaborator

Recent Papers

- Price Discounts and Cheapflation during the Post-Pandemic Inflation Surge

Alberto Cavallo and Oleksiy Kryvtsov

Alberto Cavallo and Oleksiy Kryvtsov

We study how within-store price variation changes with inflation, and whether households exploit it to attenuate the inflation burden. We use micro price data for food products sold by 91 large multi-channel retailers in ten countries between 2018 and 2024. Measuring unit prices within narrowly defined product categories, we analyze two key sources of variation in prices within a store: temporary price discounts and differences across similar products. Price changes associated with discounts grew at a much lower average rate than regular prices, helping to mitigate the inflation burden. By contrast, cheapflation—a faster rise in prices of cheaper goods relative to prices of more expensive varieties of the same good—exacerbated it. Using Canadian Homescan Panel Data, we estimate that spending on discounts reduced the change in the average unit price by 4.1 percentage points, but expenditure switching to cheaper brands raised it by 2.8 percentage points. - Markups and Cost Pass-through Along the Supply Chain

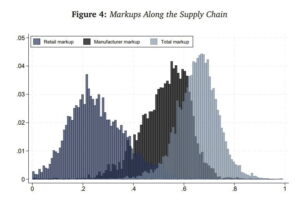

Santiago Alvarez-Blaser, Alberto Cavallo, Alexander MacKay, Paolo Mengano

Santiago Alvarez-Blaser, Alberto Cavallo, Alexander MacKay, Paolo Mengano

We study markups and pricing strategies along the supply chain. Our unique dataset combines detailed price and cost information from a large global manufacturer with matched retail prices collected online for the period July 2018 through June 2023. We show that total markups—reflecting the difference between retail prices and production costs—are stable over time, despite the inflationary period at the end of the sample. Along the supply chain, manufacturer and retail markups are negatively correlated. For the most part, we find similar patterns across countries, though there is substantial heterogeneity in the split of markups between the manufacturer and retailers. Our analysis also reveals divergent pricing behaviors in response to cost shocks. The manufacturer adjusts prices more quickly than retailers and appears to more fully incorporate idiosyncratic cost shocks to specific products. Both types of firms respond more quickly to expected costs than to unexpected costs. - Large Shocks Travel Fast

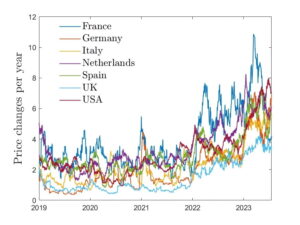

Alberto Cavallo, Francesco Lippi and Ken Miyahara

Alberto Cavallo, Francesco Lippi and Ken Miyahara

We leverage the inflation upswing of 2022 and various granular datasets to identify robust price-setting patterns following a large supply shock. We show that the frequency of price changes increases dramatically after a large shock. We set up a parsimonious New Keynesian model and calibrate it to fit the steady-state data before the shock. The model features a significant component of state-dependent decisions, implying that large cost shocks incite firms to react more swiftly than usual, resulting in a rapid pass-through to prices–large shocks travel fast. Understanding this feature is crucial for interpreting recent inflation dynamics.